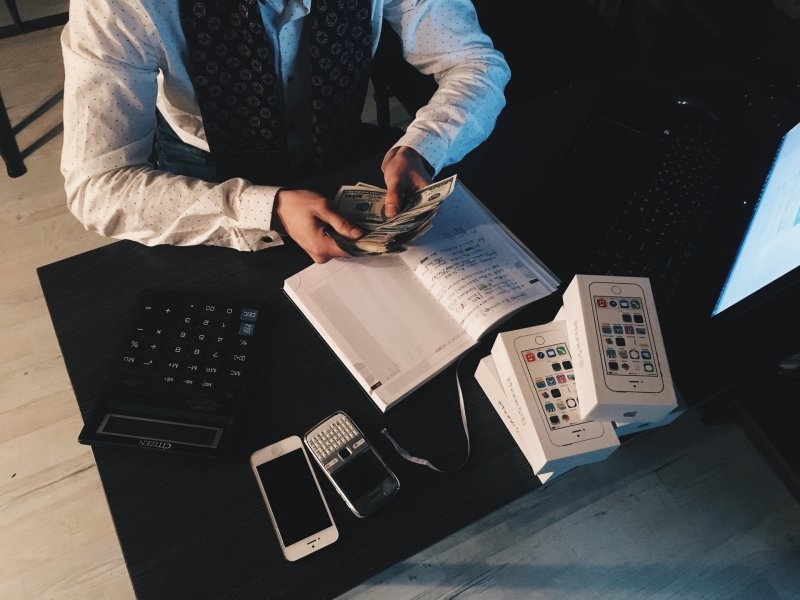

Auditing and assurance services play a crucial role in ensuring the integrity and transparency of financial information for businesses, organizations, and individuals. These services provide an independent assessment of financial statements and internal controls, helping to identify potential risks and provide recommendations for improvement. In this article, we will discuss the importance of auditing and assurance services and how they help ensure financial integrity and transparency.

Importance of Auditing and Assurance Services

Enhancing Financial Integrity: Auditing and assurance services provide an independent assessment of financial statements, ensuring that they are free from material misstatements or errors. This enhances the reliability and accuracy of financial information for stakeholders.

Identifying Risks: Auditing and assurance services help identify potential risks in financial reporting, internal controls, and operations. This allows organizations to take proactive measures to mitigate these risks and improve their overall financial management.

Compliance: Auditing and assurance services help ensure compliance with applicable laws and regulations, such as tax laws, industry-specific regulations, and accounting standards.

Investor Confidence: Independent auditing and assurance services enhance investor confidence in financial statements and the overall financial management of an organization.

Assurance Services

Assurance services refer to a range of services that provide independent assurance on non-financial information, such as sustainability reporting, data privacy, and cybersecurity. These services provide stakeholders with confidence in the reliability and accuracy of non-financial information.

Assurance services refer to a range of services that provide independent assurance on non-financial information, such as sustainability reporting, data privacy, and cybersecurity. These services provide stakeholders with confidence in the reliability and accuracy of non-financial information.

Auditing Services

Auditing services are a type of assurance service that provides an independent assessment of financial statements and internal controls. Auditors examine financial statements to ensure that they are free from material misstatements or errors, and they provide an opinion on the reliability of the financial information.

Best Practices for Auditing and Assurance Services

Independent Auditors: Auditors should be independent and objective, free from any conflicts of interest that may compromise their objectivity.

Audit Committee Oversight: Organizations should establish an audit committee to oversee the audit process and ensure that auditors have access to all relevant information.

Risk Assessment: Auditors should perform a risk assessment to identify potential risks and tailor their audit procedures accordingly.

Documenting Audit Procedures: Auditors should document their audit procedures and findings, providing a clear trail of evidence to support their conclusions.

Continuous Improvement: Organizations should use audit findings and recommendations to continuously improve their financial management and internal controls.

Auditing and assurance services play a crucial role in ensuring financial integrity and transparency for businesses, organizations, and individuals. These services provide independent assessment and identify potential risks, enhancing reliability and accuracy of financial information. By following best practices such as independent auditors, audit committee oversight, risk assessment, documenting audit procedures, and continuous improvement, organizations can ensure that they are meeting their financial reporting obligations and maintaining stakeholder confidence.