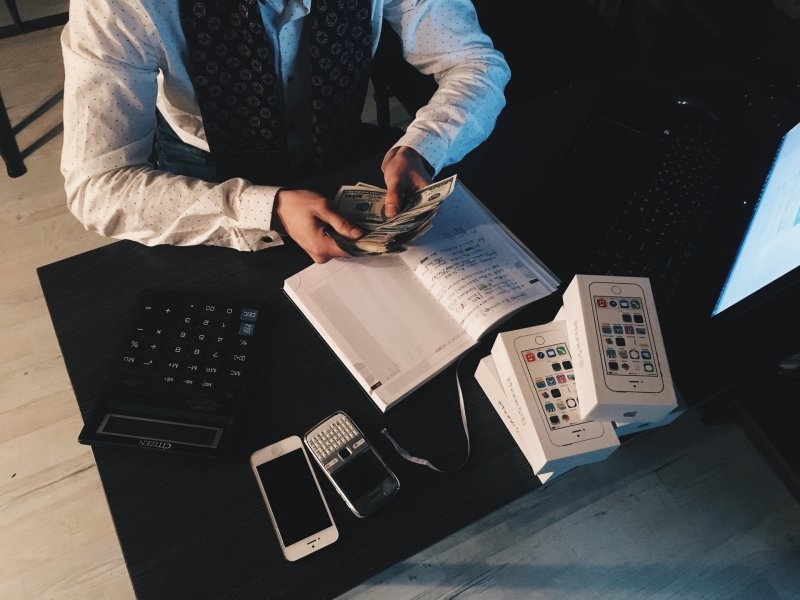

Bookkeeping and record-keeping are essential components of financial management for businesses of all sizes. They involve recording and organizing financial transactions to facilitate accurate and timely financial reporting. In this article, we will discuss the importance of bookkeeping and record-keeping and provide best practices for businesses.

Importance of Bookkeeping and Record-Keeping

Accurate financial records are crucial for businesses to make informed decisions, meet legal requirements, and obtain financing. Bookkeeping and record-keeping provide the following benefits:

Financial Management: Bookkeeping and record-keeping help businesses monitor their financial performance and identify areas for improvement. This allows for timely and informed decision-making.

Compliance: Accurate financial records are required for compliance with tax laws and regulations, as well as industry-specific regulations.

Financing: Financial institutions require accurate financial records to evaluate creditworthiness and make lending decisions.

Best Practices for Bookkeeping and Record-Keeping

Use Accounting Software: Accounting software automates many bookkeeping and record-keeping tasks, reducing the risk of errors and increasing efficiency.

Create a Chart of Accounts: A chart of accounts is a list of all the accounts used to record financial transactions. It helps businesses organize financial data and facilitates accurate and efficient reporting.

Reconcile Bank Accounts: Reconciling bank accounts ensures that all financial transactions are accurately recorded and helps identify errors or fraudulent activity.

Record Transactions in a Timely Manner: Recording transactions in a timely manner ensures that financial records are accurate and up-to-date.

Back Up Data Regularly: Backing up financial data regularly protects against data loss due to hardware failure, theft, or other disasters.

Review Financial Statements Regularly: Regular review of financial statements helps businesses identify trends, assess performance, and identify areas for improvement.

Seek Professional Assistance: Bookkeeping and record-keeping can be complex and time-consuming. Seeking professional assistance from a qualified accountant or bookkeeper can help businesses ensure that their financial records are accurate and up-to-date.

Bookkeeping and record-keeping are essential components of financial management for businesses. By implementing best practices such as using accounting software, creating a chart of accounts, reconciling bank accounts, recording transactions in a timely manner, backing up data regularly, reviewing financial statements regularly, and seeking professional assistance, businesses can ensure that their financial records are accurate, reliable, and up-to-date.